Bay Area Widow Loses Nearly $1 Million in Crypto “Pig Butchering” Romance Scam

A sophisticated online fraud known as the “pig butchering” scam has struck yet another Bay Area residen, leaving a San Jose widow in her seventies facing financial ruin and the possible loss of her home. Margaret Loke believed she had found companionship online. Instead, she was manipulated into wiring nearly $1 million to overseas scammers posing as crypto investors.

Loke, a retired widow living alone in a two-bedroom condominium in San Jose, led a quiet life. Everything changed when she met a man on Facebook who called himself Ed, claiming to be a wealthy businessman from Texas of Chinese descent. The two soon moved their conversations to WhatsApp, where daily communication created a strong emotional bond.

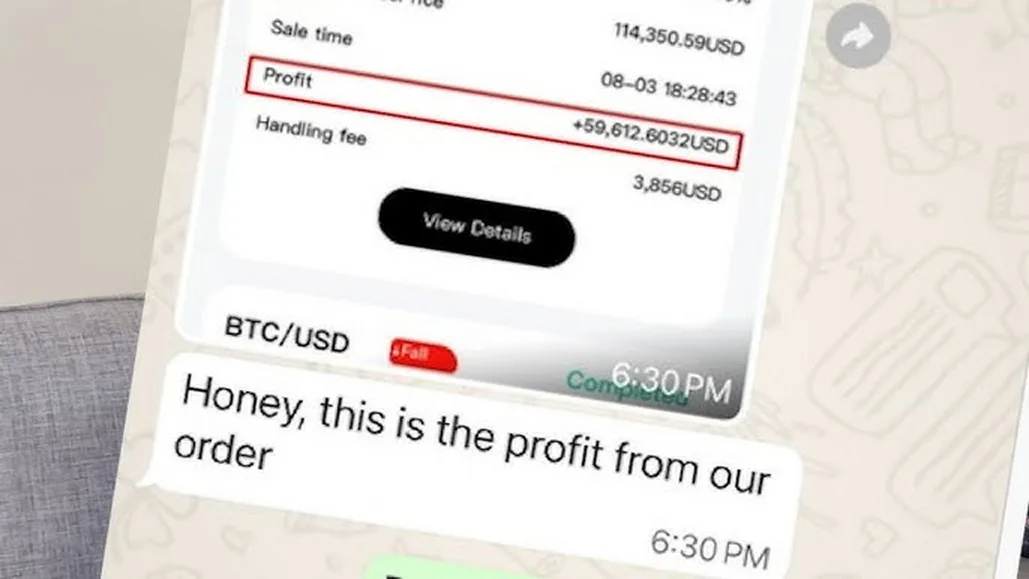

According to Loke, Ed sent her affectionate messages every morning, calling her “honey” and expressing deep emotional attachment. He wrote, “The feelings between us are real and I miss you every day. I hope our love can last forever.” Loke reciprocated, telling him, “When I think of someone special, it’s you that comes to my mind.” Despite the intimacy, Ed repeatedly refused to meet her in person and insisted their relationship remain private.

After months of emotional connection, the conversation turned to finances. Ed claimed to be highly experienced in cryptocurrency trading and encouraged Loke to invest. Initially, he suggested a modest $15,000 trade. Using a cryptocurrency platform he provided, Loke saw her balance appear to grow to $24,000 within seconds, convincing her the investment was legitimate.

Encouraged by these apparent profits, Ed urged her to invest more. Loke wired $120,000 from her IRA account through Discover Bank to the crypto account Ed had set up. Once again, the platform showed rapid gains. Ed then insisted she invest an additional $490,000, claiming this was necessary to reach a joint goal of $5 million.

Trusting him, Loke transferred the funds. She later wired an additional $62,000, emptying her IRA completely. When Ed demanded yet another $1 million, Loke told him she had no money left. His demeanor immediately changed. He began applying relentless pressure, urging her to borrow money if necessary.

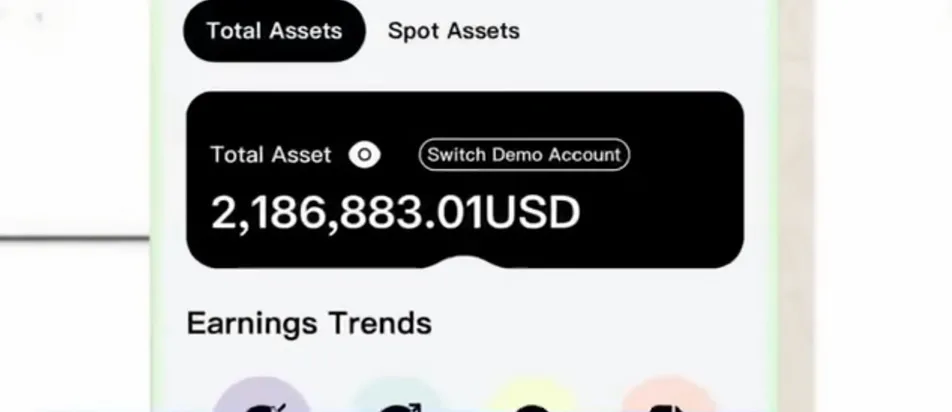

Under that pressure, Loke took out a $300,000 second mortgage on her home and wired the entire amount as well. At this point, the crypto platform indicated her account balance had grown to approximately $2.4 million. When Loke attempted to withdraw her funds, the account was suddenly frozen.

Ed told her she needed to deposit an additional $1 million to “unfreeze” the account or lose everything. He threatened legal action and left her a voicemail warning, “I don’t want us to be enemies. My lawyers will contact you.”

Desperate and confused, Loke turned to ChatGPT for advice. The response warned her that the situation was a scam and advised her to contact the police. Realizing the truth, Loke confronted Ed, accusing him of scamming her. He disappeared shortly afterward.

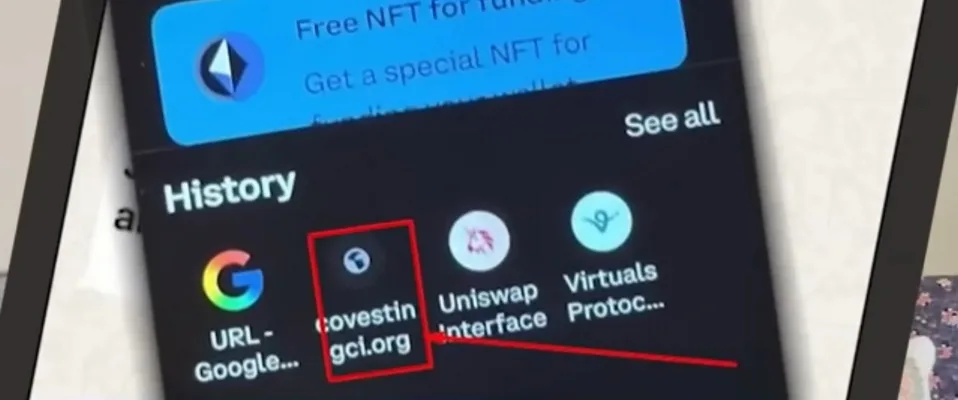

Authorities later confirmed that Loke’s money had never been invested at all. Instead, she had been wiring funds directly to a bank in Malaysia, where organized criminal groups carry out large-scale “pig butchering” scams. These operations involve building fake romantic relationships to manipulate victims into investing in fraudulent crypto platforms.

Loke is now struggling to save her home and faces a massive tax burden for withdrawing her entire IRA at once. Beyond the financial devastation, she has been left emotionally broken, questioning how she was deceived.

Consumer advocates warn that such scams are becoming increasingly common, particularly targeting older adults seeking companionship. Officials emphasize one clear rule: never invest money with someone you have never met in person, no matter how genuine the relationship may appear.