A global scammer now confesses to his past exploits, revealing how he exploited unsuspecting individuals, but has turned a new leaf by aiding a company in tracing his former counterparts. This revelation surfaces amidst a surge in tax-related scams throughout California and the Bay Area.

As per the FBI’s internet crime statistics, a staggering $394 million was lost to government impersonation scams in 2023, marking a significant increase from $241 million the previous year.

A recent report by the reverse search company Social Catfish highlights California as the most vulnerable state, with a staggering $88.3 million lost in the past year, topping the charts nationwide. Following closely, Kansas reported losses of $44 million.

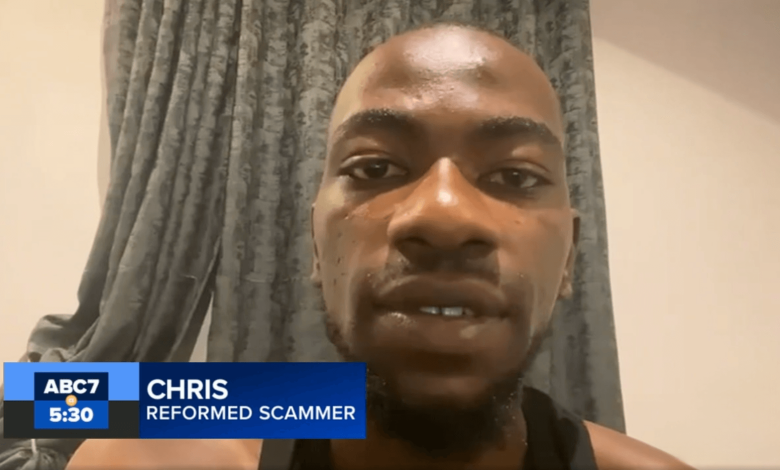

In an interview with ABC7, a reformed scammer from Nigeria named Chris opened up about his five-year stint in fraudulent activities. Chris confessed to orchestrating romance and tax-related scams, accumulating over $70,000 from his victims.

“I used to use pictures of a military personnel,” Chris disclosed. “Crafting fake profiles on social media and various apps, I would engage single women, manipulating them into falling for me before ultimately scamming them.”

In 2021, Chris says he scammed a woman for more than $30,000.

“She became depressed… she really wanted to know who I was,” Chris said.

The reformed scammers told ABC7 his victim’s family stopped communicating with her.

“I felt really bad,” he said. “So I got out.”

Chris has since turned over a new leaf and is now employed by Social Catfish, offering valuable insights into the intricate workings of scam operations worldwide.

As per Social Catfish, the top five scams to remain vigilant against include:

Turbo Tax scam – where fraudsters will send emails pretending to be from Turbo Tax – usually asking victims to update their account information or claim there is an issue with their tax return.

Experts advise to avoid third-party websites offering discounted services and go directly to turbotax.intuit.com to use their services.

Fake Accountant – scammers will impersonate a CPA and usually promise unusually high tax refunds at low prices. These payments are due upfront and the so-called accountants disappear after getting the funds.

Experts advise to perform a reverse search to confirm the identity of the CPA.

IRS spoofing call – victims receive a ‘spoofing’ call which makes the number appear it’s coming from the Internal Revenue Service. Scammers will claim the victim owes money for unpaid taxes and threatens to fine or arrest them until it’s paid. Only go to IRS.gov to make direct payments.

Unclaimed refund – Emails with a fake IRS logo tell victims they are owed more money and can immediately claim their tax refund by clicking a link and filling out information. The link is usually a phishing link designed to steal personal information. The IRS will never initiate by email, text, or social media.

Employee Retention Credit – the ERC tax credit for businesses that retained employees during COVID. Fake ads on social media claim they can help businesses get their credit immediately.