Joe Subach Thought He Was Talking to Apple Support – It Cost Him Over $1 Million

In today’s digital world, fraud is becoming increasingly sophisticated, and the story of Joe Subach serves as a cautionary tale for us all.

While trying to resolve an issue with sending money via the Apple Pay app, Joe fell victim to an elaborate scam that cost him over one million dollars.

His case, featured in a report by NBC10, underscores the importance of vigilance and how easily one can be deceived, even those who consider themselves cautious.

The Beginning of the Scam: A Fake Support Number

It all started with a simple problem: Joe was unable to send money to a friend using Apple Pay. Seeking assistance, he searched online for customer support and found a phone number. Unfortunately, the number was fake. When Joe called, he was greeted by a woman identifying herself as “Daisy from Apple.” She seemed professional and willing to help.

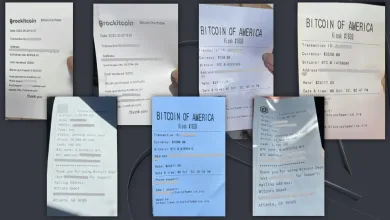

Soon after, Daisy informed Joe that his account had allegedly been hacked and his personal data was at risk. She convinced him that urgent action was necessary to protect his funds. The scammer instructed him to purchase gift cards from various stores, scratch off the protective coating, and send her the card numbers. She even coached him on what to say if store employees began asking questions: “Tell them you’re buying the cards for a friend.”

The Scam Escalates: From Financial Fraud to a ‘Romance’ Scheme

Over several months, Daisy maintained regular contact with Joe, creating an illusion of care and connection. She sent him affectionate messages like “I adore you,” shared photos of meals, and even “cooked” with him over the phone, discussing how they were chopping vegetables together. All of this was part of a manipulative effort to gain his trust. Joe saw her number constantly appearing on his phone, reinforcing the illusion that she was watching out for him.

The scam reached a new level when Daisy learned that Joe owned $780,000 worth of gold and silver, stored with Equity Trust Company. She persuaded him to withdraw the precious metals and hand them over to a courier who would come to his home. Following her instructions, Joe met individuals who arrived in a gray SUV and gave them his gold and silver.

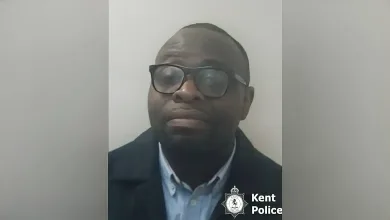

These couriers were likely what law enforcement refers to as “money mules” – individuals who, knowingly or unknowingly, help scammers move stolen funds or assets.

What Are “Money Mules”?

Nicole Senegar, Assistant Special Agent with the FBI in Philadelphia, explained that money mules typically fall into two categories:

- Some are aware they are involved in fraud and receive a share of the proceeds.

- Others may be victims themselves, unaware they are helping criminals.

In Joe’s case, the person collecting his precious metals was likely part of the scheme, though their identity remains unknown.

A Unique Case with Serious Consequences

According to Senegar, Joe’s case is unusual because it began as financial fraud, evolved into a romantic deception, and culminated in the scammers physically coming to the victim’s home. This highlights the increasingly sophisticated nature of modern fraud schemes.

Joe only realized he had been scammed when his funds were depleted and Daisy stopped responding. He reported the incident to the police, but no arrests have been made so far.

In total, Joe lost more than one million dollars in savings he had accumulated through 43 years of hard work.

How to Protect Yourself from Fraud

Joe Subach’s story is a reminder of how crucial it is to remain vigilant. Here are several tips to help protect yourself from similar scams:

- Verify sources of information: Never trust phone numbers or contact details found through general online searches. Always refer to official company websites for legitimate customer support information.

- Be wary of urgent demands: Scammers often create a sense of urgency, claiming your money or data is at risk. If you’re pressured to act immediately, that’s a red flag.

- Never share personal information: Do not provide gift card numbers, banking details, or other sensitive data over the phone or via messages.

- Watch out for emotional manipulation: Scammers may fabricate friendships or romantic relationships to build trust. Be cautious with people you only know through phone or internet interactions.

- Report suspicious activity: If you suspect you are being targeted by a scam, contact the police or your bank immediately. The sooner you act, the better your chances of recovering losses.

Conclusion

Joe Subach lost more than just money- he lost his sense of security and trust. Now, he is speaking out in hopes of preventing others from suffering a similar fate.

“If I can get the word out and if one person I can stop from falling into something like this,” he said.

In an age where technology makes our lives more convenient, it also opens the door to new forms of deception. Stay alert, verify information, and trust your instincts. Your financial security ultimately depends on you.